Roman Banking Systems: How the Empire Financed Expansion and Innovation uncovers an important yet often ignored aspect of ancient Rome—its advanced financial network. Roman banking systems were not only used for everyday business transactions; they were the driving force behind the empire’s economic power, allowing for extensive territorial growth and technological progress.

Finance in the Roman Empire was crucial for:

- Funding military campaigns that secured and expanded territories

- Supporting large-scale infrastructure projects like roads, aqueducts, and public buildings

- Facilitating trade across diverse regions with a standardized monetary system

This article delves into the evolution of Roman banking, the key figures involved, and the financial tools that enabled economic integration. It offers insights into how these ancient banking methods laid the groundwork for contemporary finance and bolstered one of history’s most influential empires.

Origins and Evolution of Roman Banking

The banking system in ancient Rome was heavily influenced by the financial practices of the Greeks. The Greeks had developed organized financial methods that the Romans adapted and expanded upon. Through trade and conquest, the Romans came into contact with Greek ways of handling money, extending credit, and creating contracts. This exposure laid the groundwork for Roman financial services to grow beyond basic barter or informal exchanges.

The Role of Private Bankers

Central to this evolution were private bankers known as argentarii. These individuals or family-run businesses began offering specialized financial services such as accepting deposits, facilitating currency exchange, and managing loans. Argentarii primarily operated in urban centers like Rome, catering to both merchants and ordinary citizens by providing them with access to more reliable monetary transactions.

The Shift Towards Structured Financial Services

The shift from informal money handling to organized financial services was a significant development in the economic life of Rome. Initially, money lending and exchange took place through personal agreements without any formal regulation. However, as argentarii gained prominence, they introduced record-keeping practices, standardized contracts, and credit instruments that fostered trust and accountability. This transition laid the foundation for a more advanced banking system capable of meeting the intricate needs of an expanding empire.

Key Developments in Roman Banking

Several key developments contributed to the evolution of Roman banking:

- Adoption of Greek contractual models adapted for Roman legal frameworks

- Argentarii acting as intermediaries in commercial transactions

- Expansion from local money changing to managing credit and deposits

These early advancements set the stage for the diverse financial roles and instruments that would later define Roman banking at its height. Such developments were not just limited to private banking but also influenced public finance and state-managed economic activities, which are further elaborated in this detailed dissertation exploring various aspects of financial evolution during this period.

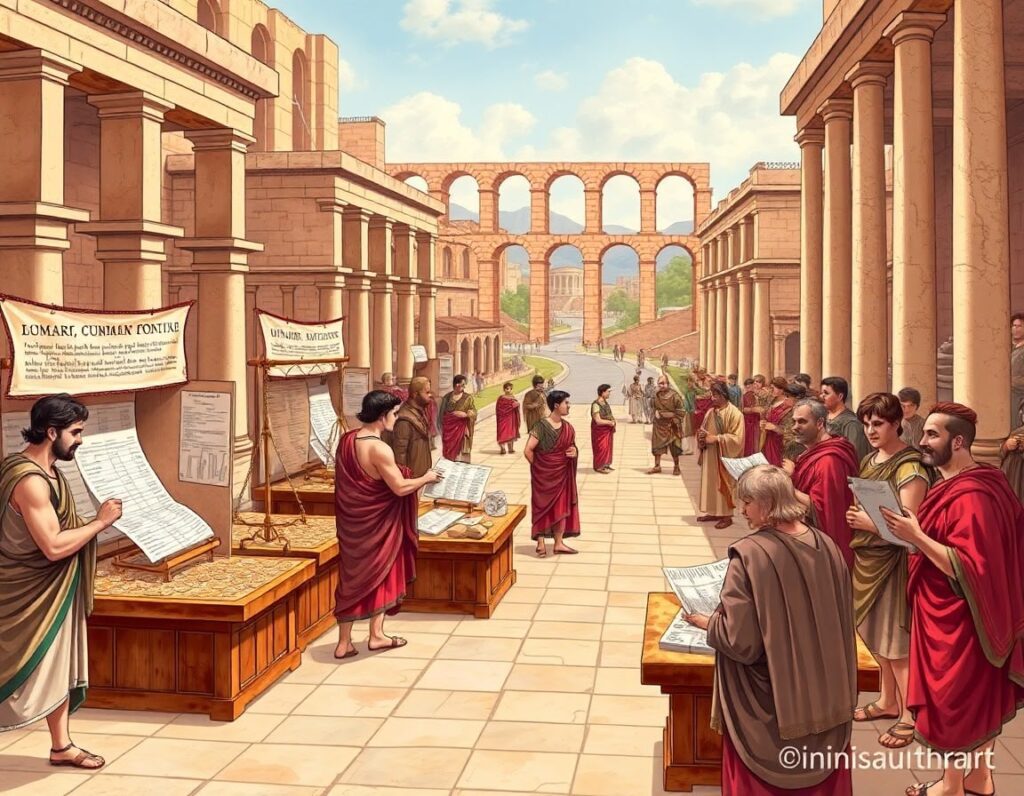

Key Players in the Roman Banking System

The Roman banking system relied on specialized roles to manage its complex financial activities. These key players ensured smooth operation across various services essential to the empire’s economy.

1. Argentarii (Bankers)

Argentarii were the backbone of Roman finance. They accepted deposits, facilitated payments, and provided loans. Their responsibilities extended to maintaining detailed records of transactions, which served as legal evidence in disputes. Argentarii also acted as intermediaries in auctions and contractual agreements, ensuring trust between parties.

2. Nummularii (Money-Changers)

Nummularii specialized in verifying and exchanging coins. Since Roman currency circulated across diverse regions with varying coin standards, their role was critical in authenticating coinage and maintaining monetary consistency. They often collaborated closely with argentarii to facilitate smooth currency exchange for commerce and personal use.

3. Coactores (Debt Collectors and Auction Agents)

Coactores managed debt recovery by collecting outstanding payments and organizing auctions for seized goods when debts were unpaid. Their work enforced financial discipline and helped maintain credit stability within the market. Acting as agents for creditors, they ensured that defaulted loans were handled efficiently.

4. Publicani

Publicani were private contractors responsible for tax collection and managing public works contracts on behalf of the state. They played a dual role by advancing funds to the government through tax farming while also investing in infrastructure projects. Their operations linked public finance directly to economic development and imperial administration.

These players formed an interdependent network, combining private enterprise with public functions that underpinned Rome’s financial system at multiple levels.

Financial Services and Instruments in Ancient Rome

Roman bankers played a crucial role by offering a variety of financial services that supported economic activities throughout the empire. Their operations went beyond simple money handling, encompassing deposit-taking, money-changing, lending, and the management of debts.

Core services included:

- Deposit-taking: Argentarii accepted deposits from individuals and businesses, safeguarding wealth while providing a basis for credit extension.

- Currency exchange: Nummularii specialized in exchanging various coins across different regions of the empire, facilitating trade despite diverse local currencies. This money-changing was essential for maintaining economic stability.

Lending was a fundamental function within Roman Banking Systems: How the Empire Financed Expansion and Innovation. Loans were typically granted with clearly defined terms regarding interest rates, collateral, and repayment schedules. Interest-bearing loans helped finance commercial ventures, agricultural activities, and even personal needs.

Financial instruments evolved to streamline credit transactions. The chirographum, a type of promissory note written on parchment or papyrus and divided into two matching parts held by lender and borrower, ensured enforceability of debt agreements. This innovation reduced disputes by providing legally recognized proof of debt obligations.

Roman bankers kept detailed records of these contracts, contributing to the reliability of credit markets. These instruments reflected an advanced understanding of credit management that underpinned commerce and innovation during the empire’s expansion phase.

Legal Framework Governing Roman Banking

Roman banking operated within a well-defined legal framework that provided structure and security for financial transactions. Two main types of loans existed: mutuum loans, which were interest-free and involved the transfer of ownership of goods or money, and interest-bearing loans that required repayment with agreed-upon interest.

Key Components of Roman Contracts

Key components of Roman contracts included:

- Loan amount: Clearly specified to avoid disputes.

- Interest rates: Varied depending on the nature of the loan, typically ranging from 6% to 12%, but could be higher in commercial contexts.

- Repayment schedules: Terms were explicitly laid out, detailing when and how repayments should occur.

- Penalties for default: Included additional fines or seizure of collateral.

Collateral was commonly used to secure loans, providing lenders with protection against borrower default. Common forms included land, slaves, or valuable goods.

Contracts were often formalized through written agreements—sometimes in the form of chirographa—and could be publicly registered. This registration was crucial for enforcing contracts in courts, ensuring legal backing for claims and dispute resolution.

The legal system’s recognition of these contracts enabled confidence in lending and borrowing, facilitating more complex financial activities across the empire. Enforcement mechanisms strengthened trust between parties, underpinning the growth and stability of Roman banking operations.

Currency Standardization and Economic Integration in the Roman Empire

The silver denarius emerged as the cornerstone of Roman monetary exchange, playing a vital role in fostering economic stability throughout the empire. Its consistent weight and purity set a reliable standard that merchants, soldiers, and officials trusted for transactions across diverse regions.

Key aspects include:

- Standardized currency: simplified trade by eliminating confusion caused by varying local coinages. The denarius became widely accepted, reducing barriers in commercial dealings.

- Monetary consistency supported an extensive network of roadways and sea routes, enabling goods to flow smoothly between provinces. Traders could confidently price commodities, knowing the value of currency was uniform.

- This uniformity underpinned economic integration, as distant parts of the empire connected through shared financial practices. Markets flourished from Gaul to Egypt, all anchored by Rome’s monetary system.

- The silver denarius also facilitated tax collection and payment of soldiers, reinforcing imperial control and administrative efficiency.

The reliability of the Roman currency system allowed banking institutions to operate with greater confidence. Argentarii and other financial agents could manage deposits, loans, and currency exchanges without concerns over fluctuating coin values. This monetary foundation supported the empire’s expansion ambitions and technological innovations by providing a stable platform for economic activity across vast territories.

How Banking Helped Fund Militaries and Expand Empires

The banking systems of ancient Rome were vital in supporting the empire’s military goals. Large-scale military operations required significant funding, which was provided by private bankers and moneylenders through efficient financial mechanisms. These institutions played a crucial role in transferring funds necessary for paying soldiers, acquiring resources, and managing logistical activities.

How Banking Funded Militaries: Key Points

- Loans and credit lines offered to military leaders allowed for quick mobilization without immediate taxation.

- Banks ensured timely payment to soldiers, maintaining their morale and loyalty.

- Banks acted as middlemen between the state treasury and regional economies, directing resources where they were most needed.

One prominent example is the financing during the Second Punic War, where a prolonged conflict against Carthage required significant monetary support. Argentarii (Roman bankers) extended credit to both the Roman government and contractors involved in war efforts. This financial assistance proved crucial in sustaining Roman armies over several years of warfare, ultimately leading to victory.

As the empire expanded into various regions, it became necessary to establish banking systems outside of Rome. Provincial branches of Roman banks emerged in major cities like Alexandria, Carthage, and Antioch. These branches played a vital role in supporting local economies by:

- Facilitating currency exchange tailored to meet regional needs.

- Providing loans for public infrastructure projects aligned with imperial interests.

- Strengthening fiscal control by directly connecting provinces to central financial networks.

The integration of provincial banking services not only reinforced imperial authority but also stimulated economic development in newly acquired territories. Thus, Roman banking served as both an economic driver and a strategic instrument behind military operations and territorial consolidation.

Political Influence and Regulation of Banking Practices in Ancient Rome

The relationship between political authorities and bankers in ancient Rome was complex and deeply intertwined. Roman politicians recognized the power of finance as a tool for maintaining social stability and economic order. This awareness led to political regulation designed to oversee banking activities and prevent financial excesses that could destabilize society.

Key aspects of this interaction included:

- Banking oversight by magistrates and censors: These officials monitored lending practices, interest rates, and the behavior of argentarii to ensure compliance with laws protecting creditors and debtors alike.

- Laws limiting usury: Roman legislation often set ceilings on interest rates to avoid exploitative lending, reflecting concerns about debt causing social unrest.

- Regulations on credit availability: Political decisions influenced who could access loans, often favoring elites involved in public service or military ventures, thereby linking financial support to political loyalty.

- Enforcement mechanisms: The legal system backed contract enforcement with penalties for default, but also allowed political authorities discretionary power to intervene in disputes affecting wider economic stability.

Political involvement in banking extended beyond mere regulation. It shaped the flow of capital within the empire, determining how credit fueled commerce, public works, and military campaigns. Banks operated not only as financial intermediaries but also as instruments through which the state could exert influence over economic life. This integration reinforced the delicate balance between private enterprise and public authority essential for sustaining Rome’s vast empire.

Decline of Roman Banking Systems: Causes and Consequences

The stability of Roman banking began to erode significantly during the 3rd century crisis, a period marked by severe economic and political challenges. Several key factors accelerated this decline:

1. Inflation driven by coin debasement

To finance military expenses and public spending, emperors repeatedly reduced the silver content in coins like the denarius. This debasement led to rampant inflation, diminishing trust in currency and complicating daily transactions for bankers and their clients.

2. Economic instability

The fluctuating value of money caused uncertainty in lending and repayment. Argentarii found it increasingly difficult to assess credit risk when the real value of loans could shift dramatically between issuance and repayment.

3. Political turmoil undermining confidence

Frequent changes in leadership, civil wars, and external invasions created an unpredictable environment for financial institutions. Political interference often disrupted banking operations, while corruption eroded public trust.

Consequences of these pressures included:

- Collapse of formal banking networks by the 5th century AD, with many argentarii ceasing operations.

- Reduction in available credit hampered commerce and innovation.

- Shift towards informal or localized financial practices as centralized systems failed.

This period marked a profound transformation where sophisticated Roman banking systems gave way to fragmented, less reliable financial arrangements, reflecting the broader disintegration of imperial structures.

Legacy of Roman Banking on Modern Financial Systems: A Lasting Impact

Roman banking laid foundational elements still evident in modern banking origins. The concept of deposit accounts, as practiced by the argentarii, introduced a secure method for individuals to store and manage money. These deposits were not mere safekeeping but often allowed for withdrawals and transfers, resembling today’s checking and savings accounts.

Interest-bearing loans, another Roman innovation, set precedents for credit systems used in contemporary finance. Romans formalized loan agreements with detailed terms on interest rates and repayment schedules, shaping how modern banks assess risk and structure lending products.

A critical legacy lies in the introduction of written transaction records. Roman bankers meticulously documented financial transactions using instruments like the chirographum. These records influenced the development of standardized accounting methods, providing transparency and legal enforceability that underpin modern financial auditing and bookkeeping practices.

The influence of Roman banking extended beyond Italy, impacting later European banking models during the Renaissance and beyond. Many principles—contract enforcement, currency standardization, and diversified financial services—trace back to Roman precedents. This continuity highlights how Roman Banking Systems: How the Empire Financed Expansion and Innovation resonates through centuries, embedding itself into the DNA of global finance today.

Key contributions include:

- Development of deposit account frameworks

- Formalization of interest-bearing loans

- Establishment of written financial documentation

- Foundations for contract law in banking

- Inspiration for European banking systems

These enduring impacts demonstrate that Roman innovations were more than historical artifacts; they form core components of current banking infrastructure worldwide.

Conclusion

The historical significance of Roman banking lies in its foundational role in shaping financial systems that continue to influence us today. Roman Banking Systems: How the Empire Financed Expansion and Innovation offers a clear example of how strategic finance supported not just commerce but also military conquest and administrative control.

Key reflections include:

- Integration of banking with state functions, demonstrating that finance was essential to empire-building.

- Innovation in legal contracts and financial instruments that set precedents for modern credit and lending practices.

- Development of standardized currency systems which underpinned economic cohesion across vast territories.

Roman bankers pioneered concepts still central to banking—such as deposit accounts, regulated interest-bearing loans, and detailed record-keeping. Their legacy persists in contemporary financial institutions and accounting standards worldwide. Understanding this ancient system deepens appreciation for how early finance enabled complex societies to grow, innovate, and sustain long-term stability.